EUR/USD Weekly Forecast: Analysis and Predictions for Forex Traders

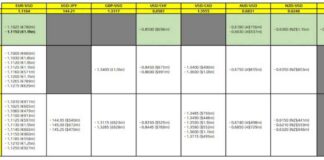

The EUR/USD pair experienced a pullback from the 1.1200 level last week, leading to a lower extension in its price movement. As we look ahead to the coming week, the initial bias remains neutral with a potential risk of a deeper decline. However, the rally from the 1.0665 level is expected to continue as long as the 1.0947 resistance turned support holds firm. If the price manages to move above the minor resistance at 1.1139, we can anticipate a retest of the 1.1200 level initially. A break above this level could potentially target the high of 1.1274 next.

Technical Analysis and Forecast

In a broader perspective, the previous break of the 1.1138 resistance signifies that the corrective pattern from 1.1274 may have completed at 1.0665. A decisive break of the 1.1274 high, which was last seen in 2023, will confirm the continuation of the overall uptrend from the 0.9534 low in 2022. The next target in this scenario would be the 61.8% projection of the movement from 0.9534 to 1.1274, calculated from the 1.0665 level, at 1.1740. This bullish scenario is likely to remain the favored case as long as the 1.0947 resistance turned support level remains intact.

Long-Term Outlook and Conclusion

Looking at the long-term picture, it is evident that a bottom was established at the 0.9534 level in 2022. The significant break of the 55-day Exponential Moving Average (EMA), currently situated at 1.1018, is considered the initial indication of a bullish trend reversal. However, a firm breakthrough of the structural resistance at 1.2348 is necessary to confirm this shift definitively. Without this breakthrough, there is a possibility that the price actions from 0.9534 could evolve into a consolidation pattern.

As traders and investors navigate the complexities of the EUR/USD pair, it is crucial to monitor key levels and technical indicators to gauge potential price movements. The interplay between support and resistance levels, along with broader market trends, can provide valuable insights into the future direction of the currency pair. By staying informed and adaptable to market conditions, traders can position themselves strategically to capitalize on opportunities in the forex market.