Understanding FX Option Expiries for September 23 10am NY Cut

As traders and investors navigate the volatile world of forex trading, it is important to pay attention to key events that could potentially impact market movements. One such event to keep an eye on is FX option expiries, which can act as important levels for price action.

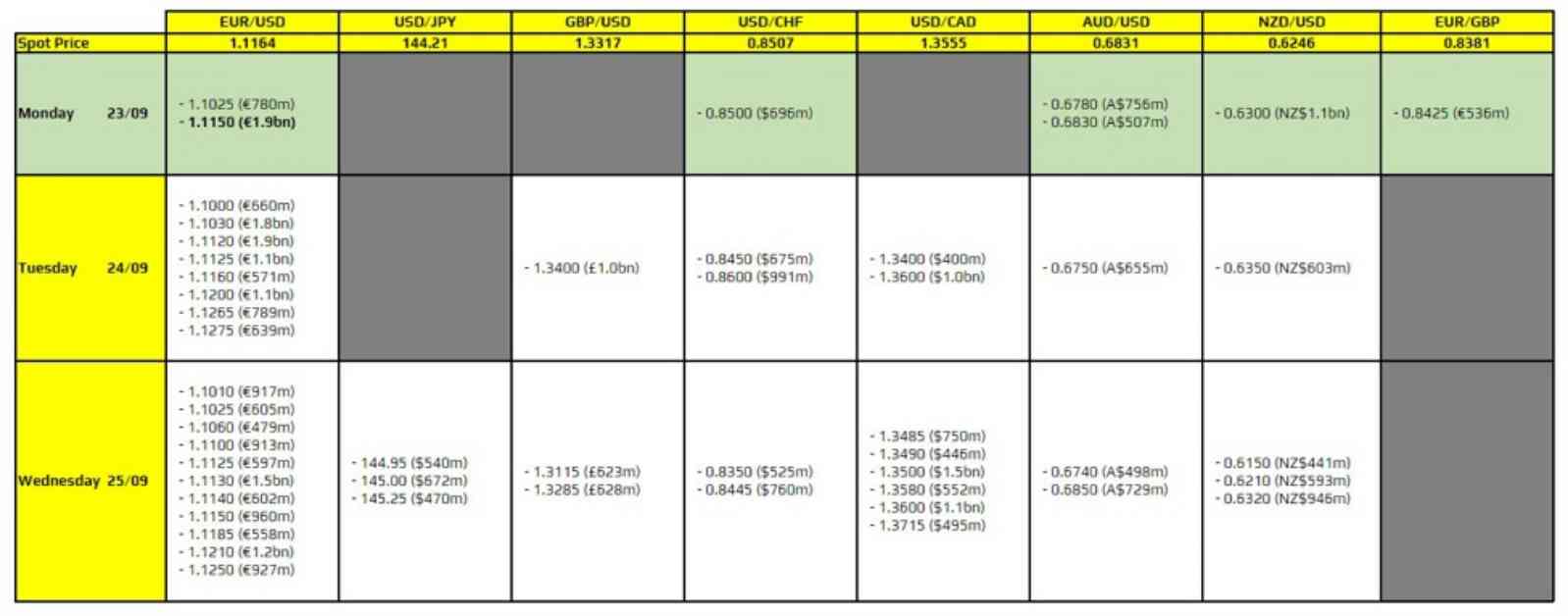

For September 23, 10am NY Cut, there is one notable FX option expiry to take note of: EUR/USD at the 1.1150 level. While this level may not hold significant technical importance, it could serve as a potential floor for price action during the trading session ahead. Additionally, the 100-hour moving average is currently hovering nearby at 1.1140, further reinforcing the importance of these levels in the near term.

Key Risk Factors for the Euro

Despite the FX option expiry and technical levels to watch, the key risk factor for the euro on September 23 will be the release of PMI data later in the day. This data could potentially move the markets and impact the euro’s performance. However, it is worth noting that the European Central Bank (ECB) has already signaled its comfort with a pause in monetary policy in October, which could mitigate the impact of the PMI data to some extent.

It is essential for traders to stay informed about these key risk factors and events that could potentially influence market sentiment and trading decisions. By understanding the potential impact of data releases and central bank decisions, traders can make more informed and strategic trading choices.

How to Utilize FX Option Expiry Data

For traders looking to make the most of FX option expiry data, it is important to consider how these levels may influence price action and market dynamics. By paying attention to key levels like the 1.1150 expiry for EUR/USD, traders can assess potential support or resistance levels and adjust their trading strategies accordingly.

Additionally, traders can use FX option expiry data in conjunction with technical analysis tools to identify potential trading opportunities. By combining fundamental data with technical indicators, traders can gain a more comprehensive understanding of market movements and make more informed trading decisions.

In conclusion, staying abreast of key events like FX option expiries and economic data releases can help traders navigate the complex world of forex trading more effectively. By understanding the potential impact of these events on market sentiment and price action, traders can make more strategic and well-informed trading choices.