USD/CAD Weekly Forecast and Analysis: Potential for Rebound Amidst Uncertainty

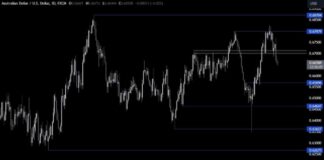

The USD/CAD currency pair experienced some fluctuations last week, edging higher to 1.3646 before facing resistance above the 38.2% retracement level at 1.3633. Despite the retreat, the pair found support at 1.3532, leaving the initial bias neutral for the upcoming week. The market sentiment remains uncertain as traders assess the potential for further movements in the pair.

Technical Analysis: Key Levels to Watch

Looking ahead, a break below 1.3532 could indicate that the corrective recovery from 1.3439 has concluded, potentially leading to a retest of the recent low. However, a strong break above 1.3646 could pave the way for a more robust rebound towards the 61.8% retracement level at 1.3752 and beyond. Traders should closely monitor these key levels to gauge the direction of the USD/CAD pair in the coming days.

In a broader perspective, the corrective pattern from the 2022 high of 1.3976 seems to be unfolding with another downward movement. While a deeper decline is possible, significant support is expected to emerge above the 1.2947 resistance turned support, signaling a potential rebound. The uptrend from the 2021 low of 1.2005 remains favorable for a resumption at a later stage, indicating a positive outlook for the pair in the long term.

Long-Term Outlook: Consolidation and Resumption of Uptrend

The price actions from the 2016 high of 1.4689 suggest a consolidation pattern that may have completed at 1.2005. This consolidation is viewed as a precursor to the resumption of the uptrend from the 2007 low of 0.9506, indicating a bullish trajectory for the USD/CAD pair in the foreseeable future. As long as the 1.2947 resistance turned support level holds, the uptrend scenario remains the preferred outcome for traders and investors.

Overall, the USD/CAD currency pair is poised for potential movements in the coming week, with key levels to watch for significant shifts in market sentiment. Traders should remain vigilant and adapt their strategies accordingly to navigate the uncertain landscape of the forex market.