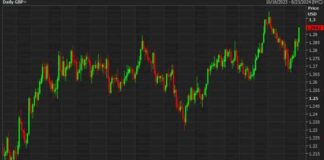

USDCAD Hits Lowest Level Since September 6

The USDCAD pair has taken a hit, dropping to its lowest level since September 6th as it follows the overall USD bias in the market. Currently trading at 1.3474, the price is inching closer to the September 6th low of 1.3465, which marked a double bottom just above the August 30th low of 1.34643. This level serves as a critical support point for buyers, who may choose to enter the market with a stop order in place in case of a break below this key level.

Technical Analysis and Market Trends

In recent trading sessions, the 200-day moving average acted as a barrier to the pair’s rally. Additionally, the convergence of the 100-hour and 200-hour moving averages around 1.3580 signaled a potential reversal point, which played out as the price hit a high of 1.3581 before retracing lower. These technical indicators provided valuable clues for sellers looking to capitalize on the market dynamics.

Bank of Canada Governor, Tiff Macklem, is scheduled to deliver a speech later today at 1:10 PM ET. The recent release of Canada’s Consumer Price Index (CPI) showed a decline of -0.2%, falling short of the expected 0.0% increase. The year-on-year CPI also dropped to 2.0%, hitting the target rate for the first time in over three years. This data, coupled with a rise in the unemployment rate to 6.6% from the estimated 6.5%, has raised concerns about the Canadian economy’s stability.

Bank of Canada’s Monetary Policy

In response to the economic challenges, the Bank of Canada made a preemptive rate cut of 25 basis points, bringing the interest rate down to 4.25% from 4.5%. However, there are questions about whether a more aggressive 50-basis point cut would have been more appropriate given the economic indicators. Investors are now eagerly awaiting Macklem’s speech for any hints of a dovish stance that could potentially attract dip buyers back into the market.

The recent uptick in oil prices, albeit slightly off their peak at $72.40, has also influenced the CAD’s performance. Currently trading at $71.50, oil prices play a significant role in the Canadian economy, although the US remains a dominant player in the oil market. Traders are advised to keep an eye on support levels near 1.3465, with stop orders in place to mitigate risks in case of a breakdown below this crucial level.

In conclusion, the USDCAD pair is navigating through a complex web of economic data, technical signals, and market sentiment. With key support and resistance levels in play, traders must exercise caution and stay informed of any developments that could impact the currency pair’s trajectory in the coming sessions.