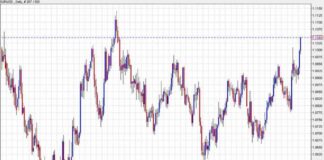

USD/JPY Daily Forecast and Analysis

The USD/JPY pair has been experiencing a downward trend, with the current fall from 149.35 still in progress. Despite weak momentum, the intraday bias remains on the downside, indicating a potential retest of the 141.67 low. A firm break below this level could signal a continuation of the downtrend towards the 139.26 Fibonacci level. It is crucial to monitor the 149.35 resistance level for any signs of a possible recovery.

Medium-Term Outlook

In the bigger picture, the fall from the medium-term high of 161.94 is viewed as a correction of the overall uptrend from 102.58 (2021 low). If the decline deepens, we could see a further drop towards the 38.2% retracement level at 139.26, which is in close proximity to the 140.25 support level. As long as the 55-week EMA (currently at 149.63) holds, the risk remains tilted to the downside. However, a decisive break above the 55-week EMA would indicate that the medium-term corrective pattern has been established.

Market Sentiment and Key Factors

Various factors can influence the USD/JPY pair’s movements, including economic data releases, geopolitical events, and market sentiment. Traders should pay close attention to key indicators such as the US Non-Farm Payrolls, Japanese GDP figures, and any updates on US-China trade relations. Additionally, shifts in risk appetite in the global markets can impact the pair’s performance, as investors seek safe-haven assets like the Japanese yen during times of uncertainty.

Technical Analysis and Trading Strategies

Traders can utilize technical analysis tools to identify potential entry and exit points for their USD/JPY trades. Key levels to watch include the 141.67 support and the 149.35 resistance. A break below 141.67 could open the door for further downside towards the 139.26 Fibonacci level, while a move above 149.35 could signal a reversal in the current trend. It is essential to set stop-loss orders and closely monitor price action to effectively manage risk and maximize potential profits.

Moreover, traders can employ various trading strategies based on their risk tolerance and market outlook. Swing traders may look for opportunities to enter short positions on pullbacks towards key resistance levels, while day traders can capitalize on intraday volatility by scalping small price movements. It is crucial to have a well-defined trading plan and adhere to risk management principles to navigate the dynamic forex market successfully.

In conclusion, the USD/JPY pair’s daily forecast and analysis suggest a bearish bias in the near term, with the potential for further downside towards key support levels. Traders should remain vigilant and adapt their strategies based on evolving market conditions to capitalize on trading opportunities. By staying informed and utilizing technical analysis tools effectively, traders can navigate the forex market with confidence and precision.