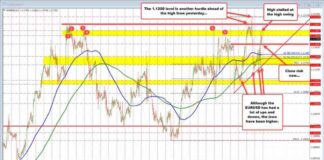

The USD/CHF pair experienced a rally from 0.8733 to 0.8916 last week, reaching as high as 0.8916 before pulling back. The retreat occurred after hitting the 61.8% retracement level of 0.9223 to 0.8374 at 0.8899. As a result, the initial bias for this week remains neutral for consolidations. However, the outlook will remain bullish as long as the 0.8773 resistance turned support level holds. If there is sustained trading above 0.8899, it could pave the way for a move back to the key resistance level of 0.9223.

Looking at the bigger picture, the price actions from the 2023 low of 0.8332 are currently viewed as a medium-term corrective pattern, with the rise from 0.8374 considered as the third leg. The overall outlook will continue to lean bearish as long as the 0.9223 resistance level remains intact. There may be a possibility of a break of the 0.8332 low at a later stage once the consolidation phase is complete.

In the long-term perspective, the price action from the 2011 low of 0.7065 is seen as a corrective pattern within the multi-decade downtrend from the 2000 high of 1.8305. The fall from the 2016 high of 1.0342 is considered as the second leg of this corrective pattern. The rejection by the 55 M EMA indicates that this downward movement is currently in progress. A break of the 61.8% retracement level of 0.7065 to 1.0342 at 0.8317 could potentially lead to a return to 0.7065 in the long run. This suggests that the USD/CHF pair may face further downward pressure in the future.