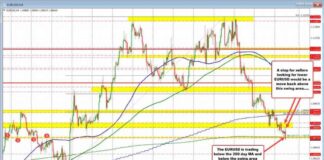

The buzz surrounding the recent election has dimmed as uncertainty looms over tariffs and high P/E ratios in the US equity market. After an initial surge following the election, most of the gains have now been wiped out, with the S&P 500 on the brink of erasing the opening gap and the Nasdaq already experiencing a significant decline.

Investors are closely watching Trump’s cabinet picks, who are emphasizing the importance of delivering on campaign promises. Of particular concern are the promises of imposing 60% tariffs on China, implementing a 10% tariff across the board, and carrying out mass deportations of 11 million illegal immigrants.

The daily closing changes in the Nasdaq are as follows:

– S&P 500: -1.3%

– Nasdaq Comp: -2.2%

– DJIA: -0.7%

– Russell 2000: -1.5%

– Toronto TSX Comp: -0.7%

Over the course of the week, the market performance has been as follows:

– S&P 500: -2.1%

– Nasdaq Comp: -3.1%

– Russell 2000: -4.0%

– Toronto TSX Comp: +0.5%

The decline in the equity market reflects the growing concerns among investors regarding the potential impact of the proposed policies on trade and immigration. The market volatility is likely to persist until there is more clarity on how these promises will be implemented and their implications for the economy.

Investors are advised to closely monitor the developments in the political landscape and adjust their investment strategies accordingly to navigate the uncertainties in the market. As the situation continues to evolve, staying informed and being prepared for potential fluctuations will be crucial for investors to protect their portfolios and make informed decisions.