Summer Madness: A Warning for Investors

In the fast-paced world of finance, it’s easy to get caught up in the daily grind of market movements and economic indicators. However, amidst all the chaos, it’s important to remember that markets are not just driven by numbers and algorithms—they also reflect human behavior and seasonal patterns. As we enter the summer months, investors should be wary of what is commonly referred to as “summer madness,” a phenomenon that can lead to increased volatility and irrational decision-making in the markets.

The Impact of Seasonal Rhythms on Markets

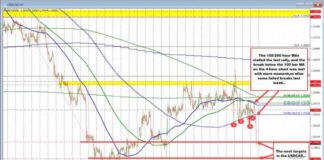

While much of modern finance is automated and operates 24/7, there are still remnants of a time when markets followed more traditional rhythms. Stock exchanges, for example, still adhere to the opening and closing bells that were established over a century ago. The foreign exchange market may operate around the clock, but there are certain times when liquidity is lower and trading volumes are reduced, such as during the early hours of the morning in London.

During the summer months, when many traders and investors take time off for vacation, the markets can experience lower liquidity and increased volatility. This can create opportunities for quick gains, but it also increases the risk of sudden price swings and market manipulation. As senior traders and decision-makers head to the beach, it’s often left to younger, less experienced traders to navigate the markets, potentially leading to missteps and costly mistakes.

Navigating the Summer Markets: Strategies for Investors

For investors looking to navigate the summer markets successfully, it’s important to be aware of the potential risks and challenges that come with the season. Here are some strategies to consider:

1. Diversification: One of the key principles of investing is diversification, spreading your investments across different asset classes and sectors to reduce risk. In times of increased volatility, having a well-diversified portfolio can help cushion the impact of market fluctuations.

2. Risk Management: Setting clear risk management parameters and sticking to them is crucial in volatile markets. Establishing stop-loss orders and monitoring your investments closely can help protect your capital and prevent significant losses.

3. Stay Informed: Keeping abreast of market developments, economic indicators, and geopolitical events is essential for making informed investment decisions. While it can be tempting to tune out during the summer months, staying informed can help you navigate the markets more effectively.

The Impact of “Summer Madness” on Investor Behavior

Summer madness can also influence investor behavior, leading to irrational decision-making and herd mentality. When markets are quieter and less liquid, investors may be more prone to following the crowd or making impulsive decisions based on short-term trends. This can result in asset bubbles, exaggerated price movements, and increased market inefficiencies.

In the past, summer madness has been associated with market crashes and financial crises. The infamous Black Monday crash of 1987, for example, occurred in October but was preceded by a period of heightened volatility and irrational exuberance during the summer months. Similarly, the dot-com bubble of the late 1990s and the global financial crisis of 2008 were fueled by speculative excess and herd mentality that were exacerbated during the summer season.

As we enter the summer months of 2024, investors should be cautious and vigilant, avoiding succumbing to the temptations of summer madness. By staying disciplined, informed, and diversified, investors can weather the storm of seasonal volatility and emerge stronger on the other side.

Strategies for Navigating Summer Madness

1. Maintain a Long-Term Perspective: During times of increased volatility and market uncertainty, it’s important to focus on the long-term fundamentals of your investments. Avoid making impulsive decisions based on short-term market movements and instead stick to your investment strategy.

2. Consider Alternative Investments: In times of market volatility, alternative investments such as real estate, commodities, or private equity can provide diversification and stability to your portfolio. These assets may not be as directly impacted by the summer madness in traditional financial markets.

3. Seek Professional Advice: If you’re feeling overwhelmed or uncertain about navigating the summer markets, consider seeking advice from a financial advisor or investment professional. They can provide valuable insights and guidance to help you make informed decisions and protect your investments.

In conclusion, summer madness is a real phenomenon that investors should be aware of and prepared for. By understanding the impact of seasonal rhythms on markets, implementing sound investment strategies, and staying disciplined in the face of volatility, investors can navigate the summer months successfully and emerge stronger on the other side.