SoundHound AI, a provider of voice generative artificial intelligence (AI), saw a significant increase in its stock price after announcing the acquisition of enterprise AI software firm Amelia for $80 million. This move is aimed at expanding SoundHound’s presence in conversational AI across various industries and brands. However, the stock price dropped by 5% in after-hours trading following the release of the company’s quarterly results. Despite beating earnings and revenue estimates, SoundHound reported a larger GAAP net loss compared to the previous year.

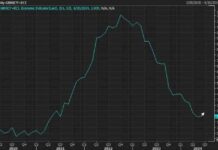

Technical analysis of SoundHound’s stock chart reveals a descending triangle pattern, typically considered bearish. However, in this case, the pattern may signal a continuation of the uptrend if formed after a period of growth. The stock closed above the 50-day moving average with significant trading volume, indicating a potential upside breakout.

Investors should pay attention to key price levels in the coming days. The stock may face resistance at $5.75, the top trendline of the descending triangle. A breakout above this level could trigger further buying activity, potentially leading to a test of $8.60. A more bullish scenario could see the stock reaching $15, where it may encounter strong resistance near its all-time high.

On the downside, investors should watch for a breakdown below $3.50, the lower trendline of the descending triangle. This could lead to declines towards crucial support levels at $2.60 and $1.60. After a 21% jump in the regular trading session, SoundHound shares fell to $4.95 in after-hours trading.

It’s important to note that the information provided in this article is for informational purposes only and does not constitute financial advice. Investors should conduct their own research and consult with a financial advisor before making investment decisions.