JP Morgan’s Call for 50 Basis Point Rate Cut Next Week

As the Federal Reserve’s September meeting looms closer, JP Morgan is making waves with its bold call for a 50 basis point rate cut. Scheduled for Wednesday at 2 PM ET, this potential move has sparked a flurry of discussions and speculations within the financial community.

Market dynamics have shifted significantly following Nick Timiraos’ insightful article that shed light on the Fed’s current predicament. What was once a lopsided 20-80 split in favor of no rate cut has now become a nearly even 50-50 divide. The stakes are high, and all eyes are on Fed Chair Powell as he contemplates the best course of action.

Former Fed members Dudley and Mester have added their voices to the mix, with Mester expressing openness to a 50 basis point cut and Dudley going a step further by explicitly endorsing it. While the Fed is currently in a blackout period, some market observers speculate whether “friends and old family members” might be subtly hinting at the Chair’s intentions behind the scenes.

The rationale for a rate cut is supported by the spread between the Fed funds rate and inflation rate, which indicates room for adjustment. Additionally, the Fed is cognizant of the lag effect that policy changes can have on the economy, prompting a proactive approach to potential adjustments. Recent data on Consumer Price Index (CPI) and Producer Price Index (PPI) have been relatively stagnant, but analysts are piecing together clues to forecast a core Personal Consumption Expenditures (PCE) increase of 0.13-0.17% for the month, pointing towards subdued inflationary pressures.

Political developments are also under scrutiny, with pundits closely monitoring Capitol Hill for signals on how policymakers may respond. A potential split in opinions could influence the Fed’s decision-making process and shape the trajectory of future policy changes.

The financial markets have reacted positively to the prospect of a rate cut this week. The Nasdaq index has surged by 6.14% over the past few days, erasing last week’s decline of -5.77%. This gain marks the largest weekly increase since October 2023, when the index rose by 6.61%. Similarly, the S&P index has also seen a significant uptick of 4.20% this week, almost offsetting the previous week’s decline of -4.25%. This week’s gain is on track to be the most substantial in 2024 and the highest since October 2023.

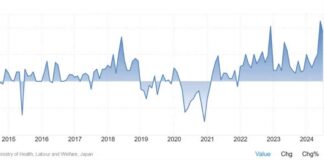

In the US debt market, there have been notable movements in yields:

– The 2-year yield has dropped by an additional -7.6 basis points this week, following a significant tumble of -27 basis points in the previous week.

– The 10-year yield has also decreased by -6.8 basis points after falling by -19.5 basis points last week.

The Road Ahead: Implications of a 50 Basis Point Rate Cut

If the Federal Reserve does indeed opt for a 50 basis point rate cut next week, the implications could be far-reaching. While such a move may provide a boost to the stock market in the short term, there are broader implications to consider.

One potential outcome of a significant rate cut is increased borrowing activity, as lower interest rates make it more attractive for businesses and consumers to take out loans. This could stimulate economic growth and investment, leading to a more robust recovery from the ongoing challenges posed by the pandemic.

However, there are also concerns about the potential risks associated with a sharp rate cut. Critics argue that such a move could fuel inflationary pressures and destabilize financial markets, leading to increased volatility and uncertainty. Additionally, a drastic rate cut could signal to investors and the public that the Fed is concerned about the state of the economy, potentially eroding confidence in the recovery.

Market Sentiment and Investor Confidence

The current market sentiment is a delicate balance between optimism and caution, as investors weigh the potential outcomes of the upcoming Fed decision. While the prospect of a rate cut has buoyed stock prices and driven yields lower, there is also a sense of apprehension about the broader implications of such a move.

Investor confidence is a key factor that will shape the response to the Fed’s decision next week. A decisive and well-communicated rate cut could instill trust in the Fed’s ability to navigate the economic challenges ahead. Conversely, a lack of clarity or consensus on the need for a rate cut could lead to increased uncertainty and market volatility.

As the countdown to the Fed’s September meeting continues, all eyes are on Chair Powell and his fellow policymakers as they grapple with the decision before them. The implications of a 50 basis point rate cut are significant, and the ripple effects of this move will be felt across the economy and financial markets in the days and weeks to come.