GBP/JPY Forecast: Mid-Day Analysis and Outlook for Action Forex Traders

GBP/JPY has been a hot topic among Forex traders lately, with its recent break of the 38.2% retracement level of 208.09 to 180.00 at 190.73 signaling a potential shift in the market. This move suggests that the decline from 208.09 may have already completed at 180.00, paving the way for a rise in the pair. Let’s delve deeper into the current analysis and outlook for GBP/JPY traders.

Intraday Bias and Key Levels

The rise from the 180.00 level is now viewed as the second leg of a corrective pattern from 208.09, indicating an upside bias for the pair. Intraday traders are focusing on the 61.8% retracement level at 197.35 as the next target. However, it’s crucial to keep an eye on the downside as well. A break below the minor support level at 187.84 could shift the bias back to the downside, with a potential retest of the 180.00 level.

Daily pivots for GBP/JPY currently stand at (S1) 188.05, (P) 188.74, and (R1) 189.62, providing key levels for traders to watch. These pivot points can serve as indicators of potential support or resistance levels during intraday trading sessions.

Bigger Picture and Market Outlook

Zooming out to the bigger picture, price actions from 208.09 are viewed as a correction to the overall rally from the 123.94 low in 2020. The recent developments in the market suggest that the first leg of this correction has been completed, setting the stage for a medium-term consolidation phase. The range for this consolidation is expected to be between the 38.2% retracement level at 175.94 and the 208.09 high.

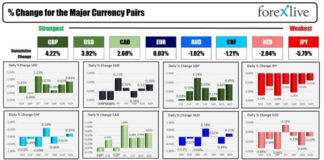

Traders and analysts are closely monitoring how GBP/JPY will navigate within this consolidation range and whether it will break out to resume the upward trend from the 123.94 low. The market outlook for GBP/JPY hinges on various factors, including economic data releases, central bank policies, and geopolitical events that could impact the currency pair’s movement.

Technical Analysis and Trading Strategies

Technical analysis plays a significant role in shaping trading strategies for GBP/JPY. Traders often use indicators such as moving averages, Fibonacci retracement levels, and trend lines to identify potential entry and exit points. The recent break of the 38.2% retracement level at 190.73 has sparked interest among traders, with many looking to capitalize on the potential upside momentum.

Some traders may opt for a breakout strategy, aiming to enter long positions if GBP/JPY surpasses the 61.8% retracement level at 197.35. Others may prefer a more conservative approach, waiting for confirmation of a sustained uptrend before committing to bullish positions. Risk management is crucial in forex trading, and traders should always consider setting stop-loss orders to protect their capital.

Market Sentiment and Risk Factors

Market sentiment surrounding GBP/JPY is influenced by a combination of fundamental and technical factors. Economic indicators, such as GDP growth, inflation rates, and employment data, can impact the currency pair’s valuation. Additionally, geopolitical events, such as Brexit negotiations and trade tensions, can introduce volatility into the market.

Traders should also be mindful of risk factors that could affect GBP/JPY, such as interest rate decisions by the Bank of England and the Bank of Japan, as well as global economic trends. It’s essential to stay informed about market developments and maintain a disciplined approach to trading to navigate potential risks effectively.

Overall, the outlook for GBP/JPY remains dynamic, with traders closely monitoring key levels and indicators to make informed trading decisions. By staying attuned to market trends and adopting sound trading strategies, forex traders can position themselves for success in the ever-evolving currency market.