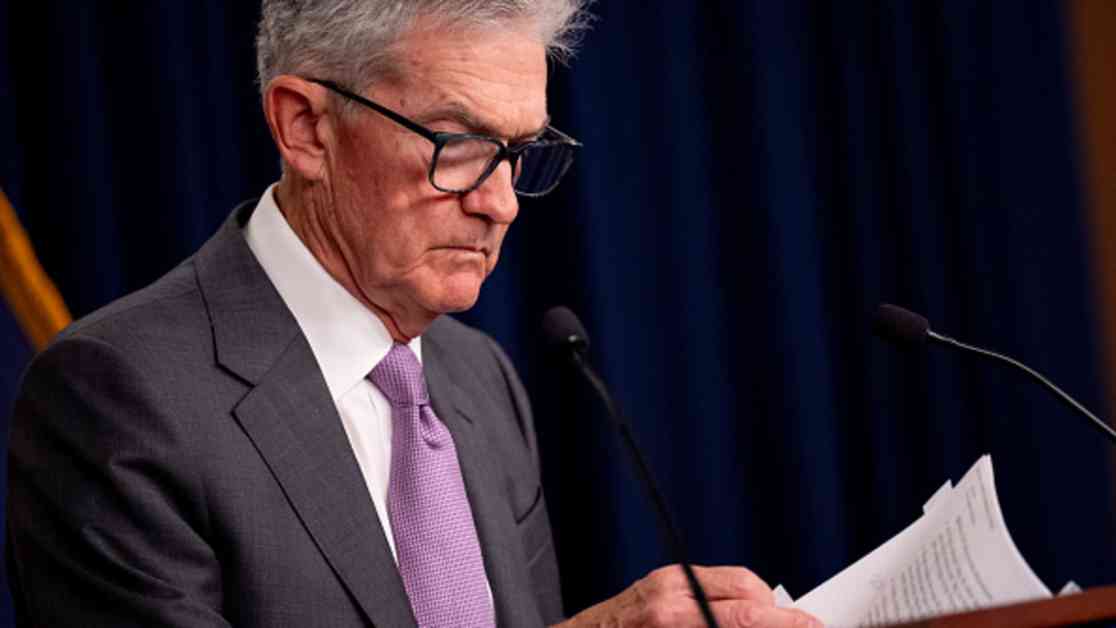

Federal Reserve Chairman Jerome Powell and the rest of the central bank are facing a critical decision that could impact the economy and the financial markets. The recent turbulence on Wall Street has raised concerns about a possible recession, and many investors are looking to the Fed for guidance.

Economists like Steven Blitz are urging the Fed to take action to prevent a recession by cutting interest rates. There is a growing consensus on Wall Street that a recession is imminent unless the Fed intervenes. The weak jobs report and disappointing economic data have only added to the sense of urgency.

Traders are already pricing in the likelihood of a significant rate cut in September, with expectations that the Fed could reduce rates by up to 2.25 percentage points by the end of next year. The Fed’s current target rate is between 5.25%-5.5%, and a series of rate cuts could bring it down significantly.

While some economists like Joseph LaVorgna are advocating for aggressive rate cuts to stimulate the economy, others like David Rosenberg are cautioning against overreacting. They believe that the Fed needs to strike a balance between preventing a recession and avoiding unnecessary panic in the markets.

Despite the growing calls for immediate action, an emergency rate cut before the next Federal Open Market Committee meeting in September seems unlikely. The Fed is expected to follow a deliberate and strategic approach to easing rates, starting with a possible cut later this month.

The upcoming policy speech by Powell at the Fed’s annual retreat in Jackson Hole, Wyoming will provide more clarity on the central bank’s easing path. Investors will be closely watching for signals on how the Fed plans to navigate the current economic challenges.

Overall, the Fed’s response to the current economic conditions will be crucial in determining the trajectory of the economy in the coming months. While the possibility of a recession looms large, the central bank has the tools and flexibility to mitigate the risks and support growth. It remains to be seen how the Fed will navigate the delicate balance between stimulating the economy and maintaining stability in the financial markets.