The latest PMI figures were just released, and unfortunately, they were not as positive as analysts had hoped. Both the Flash Manufacturing PMI and Flash Services PMI for Germany and France fell below the 50.0 threshold, indicating a slowdown in Europe’s economy.

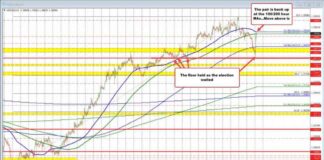

This news has had a negative impact on the euro, causing it to weaken even further. The EUR/USD chart has been on a downward trend since early October, with key levels being breached:

– Support near the 1.0800 level was broken earlier, which was drawn through the spring-summer lows.

– Today, the pair dropped below the key psychological level of 1.0500 and even below the 2023 low.

Currently, bears seem to be in control as EUR/USD trades near the lower boundary of the downward channel. Both the channel median and the 1.0500 level are acting as resistance, as indicated by arrows on the chart.

However, there might be some hope for bulls as well. Today’s candle shows a long lower shadow, which could indicate emerging demand that may provide support for the struggling euro.

If you’re interested in trading forex, you can trade over 50 forex markets 24 hours a day with FXOpen. They offer low commissions, deep liquidity, and spreads from 0.0 pips. FXOpen is a global Forex and CFD Broker that was founded in 2005 and has since gained a solid reputation in the industry. They offer a variety of platforms and trading instruments, including FX, indices, shares, commodities, and cryptocurrencies.

It’s important to note that trading CFDs can be risky, and FXOpen’s PAMM technology is not available in all jurisdictions. Additionally, cryptocurrency CFDs are not available to Retail clients at FXOpen UK.

Overall, the current situation with the EUR/USD pair is concerning, and traders should proceed with caution in these volatile market conditions.