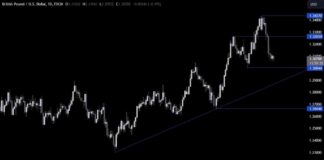

The EUR/USD pair experienced a notable fall recently after being rejected by the 55 4-hour Exponential Moving Average (EMA) at 1.0832. Despite this, it managed to stay above the temporary low of 1.0760. At the moment, the intraday bias remains neutral. There is an expectation of further decline as long as the resistance level of 1.0871 holds. If the price falls below 1.0760, the next target would be the 61.8% retracement level of 1.0447 to 1.1213, which stands at 1.0740. A decisive break below this level could lead to a target of the 1.0601 support level.

On the other hand, there is a bullish convergence condition observed in the 4-hour Moving Average Convergence Divergence (MACD) indicator. If the resistance level of 1.0871 is broken, it could indicate a short-term bottoming process and shift the bias back to the upside. In this case, the next target would be the 55-day EMA at 1.0956.

Looking at the bigger picture, the price movements from the high of 1.1274 in 2023 are viewed as a consolidation pattern within the upward trend from the low of 0.9534 in 2022. The recent fall from 1.1213 can be seen as the third leg of this consolidation. It is anticipated that the downside will be limited by the 50% retracement level of the upswing from 0.9534 to 1.1274, which is at 1.0404. This could potentially pave the way for a resumption of the upward trend in the future.