Credo Technology, a prominent player in the high-speed connectivity market, is poised for significant growth in the coming years. With a focus on AI and data center expansions, the company is expected to double its AI-related revenue by FY25. Analysts are initiating coverage with a ‘Buy’ rating and a one-year price target of $35 per share, anticipating over 70% year-over-year revenue growth in Q1 FY25.

**Leadership in High-Speed Connectivity Market**

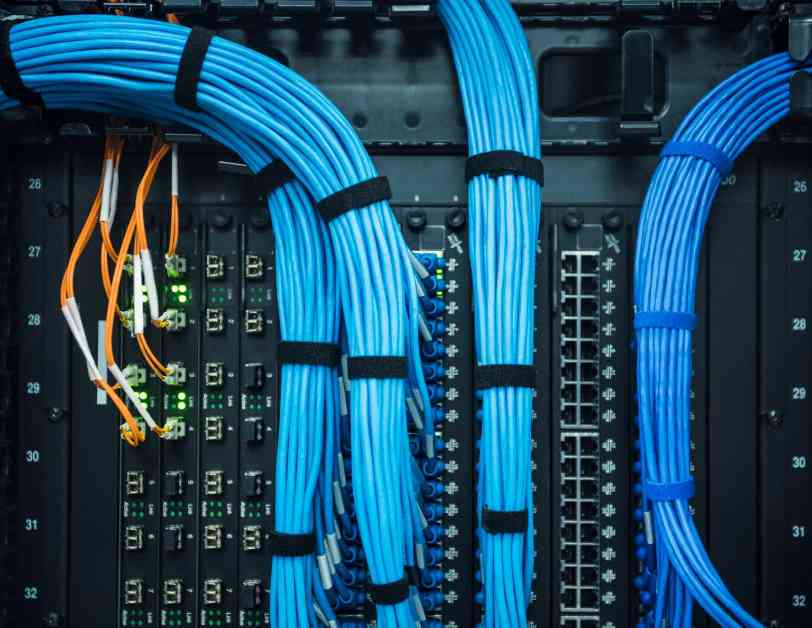

Credo Technology specializes in high-speed connectivity products for data centers and hyperscalers, offering solutions designed for Ethernet port speeds ranging from 100 gig up to 1.6 terabits per second. The company’s HiWire Active Electrical Cables (AEC) are a leading solution for in-rack cable connectivity, offering superior signal integrity, power, and reliability. Additionally, Credo’s optical digital signal processors (DSPs) play a crucial role in optical transceivers used in AI clusters.

The expanding AI market has driven a surge in data center constructions, leading to increased demand for high-speed connectivity products. Credo is well-positioned to capitalize on this growth, with 75% of the company’s total revenues derived from AI workloads in FY24. With expectations to double this revenue by FY25, Credo’s comprehensive Ethernet connectivity solutions are set to drive significant growth.

**Outlook and Valuation**

Credo is set to release its Q1 FY25 earnings, with guidance for more than 70% year-over-year revenue growth. The company anticipates revenue growth accelerating throughout the year, particularly driven by an increase in AI-related revenue in the second half of FY25. Despite robust revenue growth in recent quarters, Credo remains an early-stage growth company, requiring heavy investments in R&D and sales & marketing to scale its operations.

Analysts estimate that Credo generated $140 million in AI workloads revenue in FY24, with expectations to double this figure to $280 million by FY25. Microsoft, the company’s largest customer, is planning to double new data center capacity, driving significant demand for Credo’s connectivity products. Non-AI revenue is also projected to grow by 10% in FY24, contributing to an estimated 80% total revenue increase in FY25.

**DCF Analysis**

A discounted cash flow (DCF) analysis indicates a one-year price target of $35 per share for Credo Technology. The cost of equity is estimated at 17%, factoring in a risk-free rate of 3.8%, a beta of 1.98, and an equity risk premium of 7%. With a focus on AI-related revenue growth and margin expansion opportunities, analysts are optimistic about Credo’s future prospects.

**Key Risks**

Credo faces significant customer concentration risk, with its three largest customers accounting for over 60% of total revenue. Additionally, high spending on stock-based compensation (SBC) poses challenges for margin expansion. Competition from industry giants like Broadcom and Marvell also presents a risk, although Credo’s focused approach in the market could provide a competitive advantage.

**End Note**

With technology leadership in the high-speed connectivity market and strong growth drivers from the AI boom, Credo Technology is well-positioned for success. Analysts are initiating coverage with a ‘Buy’ rating, highlighting the company’s growth potential and one-year price target of $35 per share. As Credo continues to innovate and expand its offerings, investors are optimistic about the company’s future growth trajectory.