The Canadian dollar has been struggling against the US dollar for the past ten trading days, dropping by 2.1% in October. Currently, USD/CAD is trading at 1.3811, showing a 0.11% increase in Tuesday’s session.

The focus is now on Canada’s inflation rate, which is expected to dip below 2%. Inflation has been on a downward trend, with August’s CPI hitting a milestone by dropping from 2.5% to 2%, meeting the Bank of Canada’s target. This marked the lowest level since February 2021.

The trend is anticipated to continue in September, with market estimates at 1.8%. The two key core measures are predicted to hover around 2.4%. Monthly projections suggest a decrease to -0.1%, compared to August’s 0.1%. The decline in gasoline prices is expected to contribute to keeping September’s CPI below 2%.

The upcoming CPI release is crucial as it is the final key economic report before the Bank of Canada announces its next rate decision on October 23. With inflation under control, the Bank of Canada has shifted its focus towards the labor market. Despite three rate cuts this year due to falling inflation and a weaker labor market, the BoC now aims for a more gradual approach.

The stronger-than-expected September employment report supports the case for a modest 25-basis point rate cut rather than a larger 50-bps move in October. While the BoC prefers gradual rate trimming, if economic data disappoints, a 50-bps cut could be on the table.

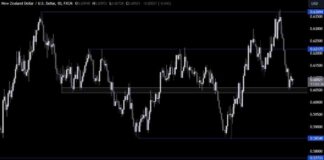

In terms of technical analysis, USD/CAD is facing resistance at 1.3816, with further resistance at 1.3834. The next support levels are at 1.3786 and 1.3768.

As investors and traders await the CPI release and the Bank of Canada’s rate decision, uncertainty looms over the Canadian dollar’s performance against the US dollar. The outcome of these events will likely have a significant impact on the direction of the currency pair in the near future.

MarketPulse is a valuable resource for forex, commodities, and global indices research, providing timely and accurate information on economic trends and events that influence various asset classes. Remember, the information provided in this article is for general purposes only and should not be considered as investment advice. It is essential to conduct thorough research and analysis before making any investment decisions.