The Bank of Japan recently held a meeting in September where they discussed their monetary policy in light of global economic uncertainties. During the meeting, the Bank decided to keep its interest rate steady at 0.25%.

Looking towards the future, members of the Bank expressed a consensus that if Japan’s economic and inflation outlook remains in line with their expectations, they will continue to gradually increase the policy interest rate and adjust their level of monetary accommodation accordingly.

In the meeting minutes, there was a clear emphasis on the importance of remaining vigilant due to uncertainties in overseas economies, especially in the United States, as well as the ongoing volatility in global financial markets. This cautious approach reflects the Bank’s commitment to carefully monitoring the situation before making any significant changes to their monetary policy.

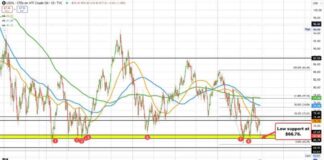

One interesting point raised by some members was the fact that the recent stabilization of the Yen’s depreciation has helped to alleviate some of the upward pressure on inflation from import prices. This development has given the Bank more time to assess the impact of global economic trends and recent policy rate hikes before making any further decisions.

Overall, the minutes from the BoJ meeting highlight the Bank’s cautious stance on monetary policy in the face of global economic risks. By carefully monitoring the situation and remaining vigilant, the Bank hopes to ensure stability and sustainable growth in the Japanese economy.