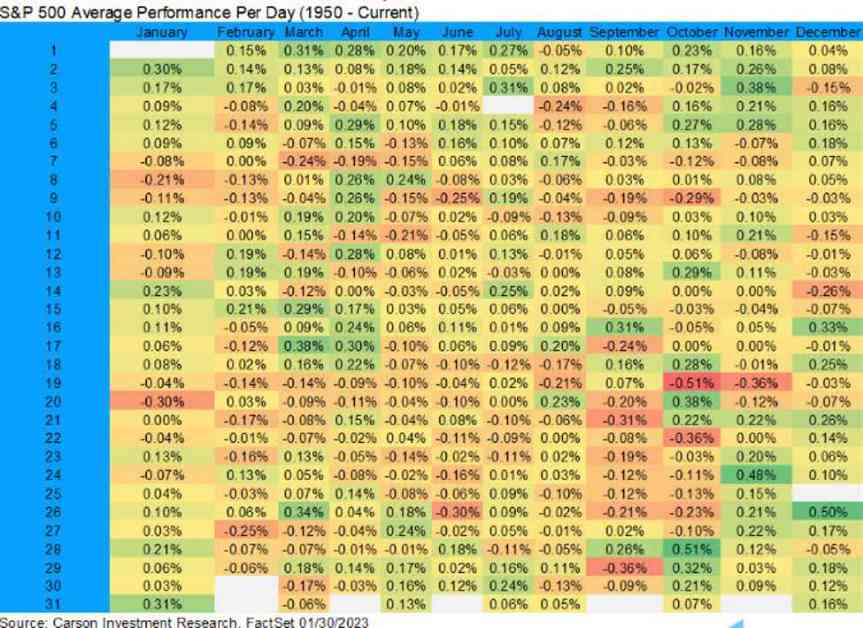

According to Carson Investment Research, October 28 has historically been the best day of the year for the S&P 500. While daily averages may be influenced by unique events, Goldman Sachs also points out that today marks the first day of the open window period for corporate buybacks, with approximately 50% in open window today.

Although the significance of buybacks may be debatable, it is worth noting that the period from now until November 5 has historically been a very strong period for the market. It may require strong nerves to navigate through this time due to the uncertainty surrounding various events, but historically, being long on the market the day after a local election has proven to be a good bet.

For example, Japan’s Nikkei rose by 1.8% today, despite surprising results. As the saying goes, “there is always another trade,” which is especially relevant in the current volatile market conditions. It is essential not to make hasty decisions that could potentially jeopardize a good year.

In times of uncertainty, it can be helpful to visualize the potential future pain. By envisioning the rollercoaster of events and uncertainties that may unfold this week, one can mentally prepare for the unpredictability of the market. It is crucial to remember that no one can accurately predict how events will unfold, and it is essential to remain cautious and strategic in decision-making.

As investors navigate through this period of uncertainty, it is important to stay informed, seek advice from financial experts, and make well-thought-out decisions. By staying vigilant and proactive, investors can better position themselves to weather the storm and potentially capitalize on opportunities that may arise in the market.