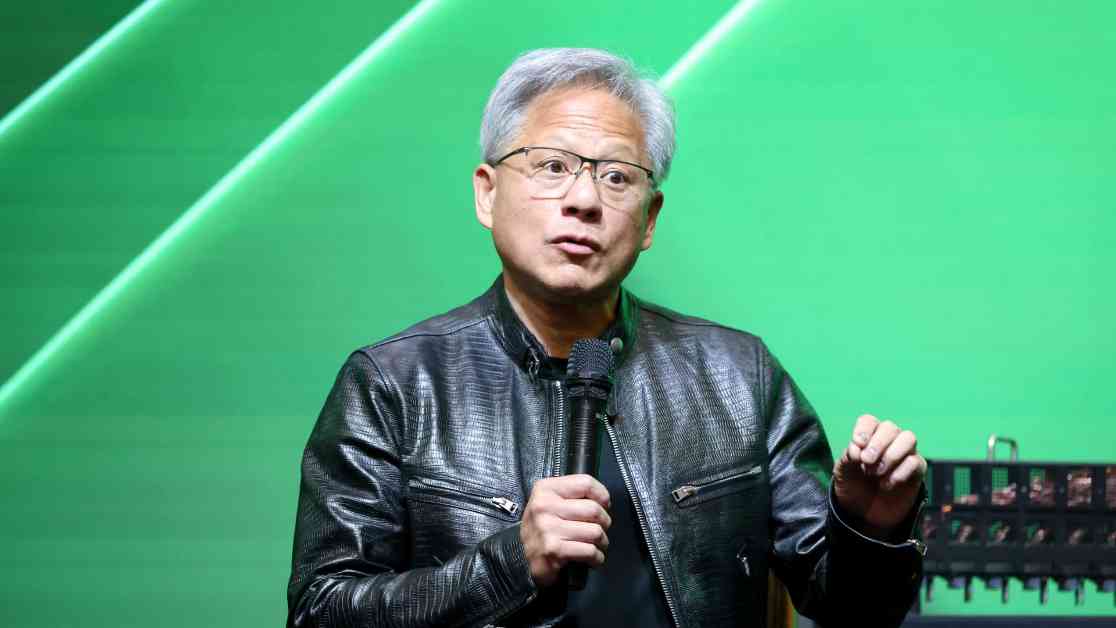

Nvidia, a leading chipmaker in the technology industry, is set to release its second fiscal-quarter earnings report after the bell on Wednesday. CEO Jensen Huang recently spoke at Computex 2024 in Taipei, showcasing the company’s latest innovations and advancements in the field of artificial intelligence. With Wall Street eagerly anticipating the results, let’s delve into the analysis and insights surrounding Nvidia’s performance in the quarter ending in July.

The Expectations

According to estimates from LSEG, analysts are projecting Nvidia to report earnings per share of 64 cents adjusted and revenue of $28.7 billion for the second fiscal quarter. As the primary beneficiary of the ongoing artificial intelligence boom, Nvidia has seen its market value soar, expanding more than nine times since the end of 2022. Investors are keen on understanding the company’s financial performance and growth trajectory amidst the evolving landscape of AI technology.

Market Dynamics

Nvidia’s dominance in the AI space has been a key driver of its success, with the company consistently delivering strong revenue growth over the past few quarters. However, as year-over-year comparisons become more challenging, analysts anticipate a slowdown in overall growth for the next seven quarters. The upcoming October-quarter forecast will be crucial in validating Nvidia’s stock price, with analysts expecting earnings per share of 71 cents on $31.8 billion in sales, representing a substantial 77% annual revenue growth.

Nvidia’s Chief Financial Officer, Colette Kress, is expected to provide valuable insights to investors during the analyst call, shedding light on the returns on investment that customers are experiencing with Nvidia’s products. This data will be instrumental in gauging the company’s performance and market positioning in the competitive landscape of semiconductor technology.

Product Innovation

One of the key areas of interest for investors is the launch of Nvidia’s next-generation Blackwell AI chips. Earlier announcements from CEO Jensen Huang hinted at significant revenue contributions from these new chips in the current year. However, speculations and media reports suggest potential delays in the launch of the Blackwell chips, potentially impacting the company’s revenue projections.

Despite the uncertainty surrounding the Blackwell AI chips, Nvidia is well-positioned to leverage its current-generation Hopper sales, particularly with the newer H200 chip gaining traction in the market. The company’s commitment to innovation and product development remains a driving force behind its success, with investors closely monitoring the progress of upcoming releases and their impact on revenue growth.

In conclusion, Nvidia’s upcoming earnings report presents a pivotal moment for the company as it navigates through a rapidly evolving technology landscape. With a strong focus on artificial intelligence and cutting-edge chip technologies, Nvidia continues to be a frontrunner in the semiconductor industry. Investors and analysts alike will be closely watching the earnings announcement for valuable insights into the company’s financial performance and future prospects.