Workday Stock Price Analysis: Key Levels to Monitor Amid Strong Earnings Surge

Workday, a leading provider of human resources and capital management software, saw its stock price surge by 11% in after-hours trading on Thursday following the release of its quarterly earnings report. The company reported results that exceeded analysts’ estimates and highlighted growth opportunities in international markets, sparking investor optimism.

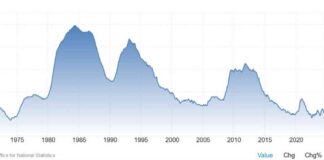

Double Bottom Breakout: A Positive Sign

One notable development in Workday’s stock chart is the formation of a double bottom pattern between June and August. This pattern is a well-known technical indicator that suggests a potential reversal in the stock’s downward trend. Additionally, the relative strength index (RSI) indicator showed a bullish divergence as the second bottom of the pattern formed a lower low, indicating a possible easing of selling pressure.

Furthermore, the stock price has recently reclaimed the 50-day moving average and is poised to break out above the neckline of the double bottom pattern. This breakout could signal further upward momentum for Workday’s shares.

Key Price Levels to Monitor

After the post-earnings surge, investors should pay attention to three important price levels in Workday’s stock:

1. $264: This level may encounter overhead resistance from a trendline connecting three troughs that formed between December and March, along with a late May peak. Investors should watch for potential selling pressure around this level.

2. $279: Another key level to monitor is $279, where the stock could face resistance near a horizontal line linking trading levels from December to March. This level includes the opening price of a significant stock gap in early March, indicating potential selling pressure.

3. $306: The highest price level to watch is $306, which is likely to attract attention around the stock’s late February record close. This area also aligns with a bars pattern price target when considering the up-trending move from September to February.

Technical Analysis Insights

Technical analysis of Workday’s stock chart provides valuable insights for investors. The recent double bottom breakout, coupled with bullish divergence in the RSI indicator, suggests a potential reversal in the stock’s downward trend. Additionally, the stock’s reclaiming of the 50-day moving average and positioning for a breakout above the neckline of the double bottom pattern indicate strong bullish momentum.

Investor Sentiment and Market Trends

Workday’s stock has faced scrutiny this year due to concerns about enterprise customers reducing spending on premium software subscription services amid macroeconomic uncertainty. However, the company’s positive quarterly results and growth opportunities in international markets have renewed investor confidence in the stock.

Overall, monitoring key price levels and technical indicators can help investors make informed decisions about Workday’s stock amid its strong earnings surge. By staying attuned to market trends and utilizing technical analysis tools, investors can navigate the stock’s price movements effectively.