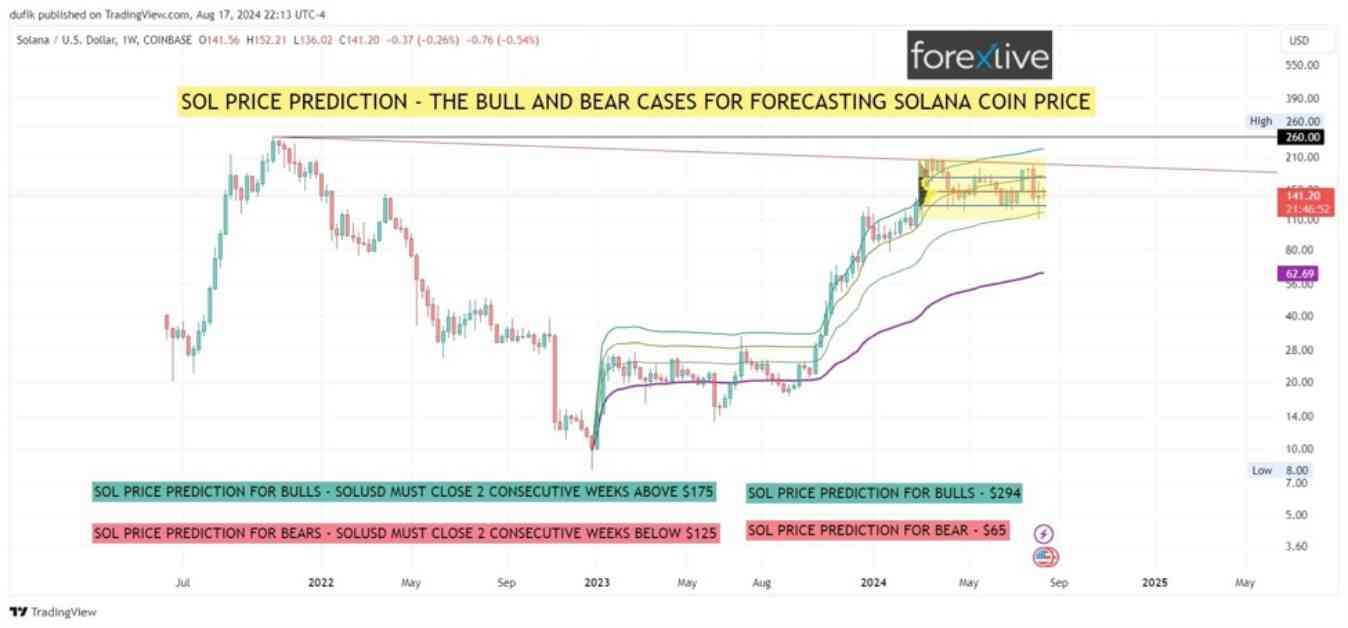

Solana (SOL) Price Prediction 2021: An In-depth Analysis for Cryptocurrency Investors

Solana (SOL) has emerged as a prominent player in the cryptocurrency space, garnering attention for its high-performance blockchain technology and impressive market value growth. As an avid trader of Solana since its early stages, I have witnessed firsthand the rapid shifts in market sentiment that characterize the crypto landscape. The meteoric rise of SOL in 2021, soaring from under $1 to over $200 within a year, underscored the widespread adoption of its blockchain for decentralized applications. Even more recently, SOL experienced a significant price increase, crossing a 66-day high of approximately $127, followed by a 67% surge in just 17 days.

The crypto market is inherently volatile, and understanding key resistance and support levels is essential for navigating these fluctuations effectively. In this analysis, we will delve into the bullish and bearish scenarios for Solana’s future price movements, offering insights for potential investors and traders.

Current Price Analysis: Evaluating Support and Resistance Levels

At present, Solana (SOL) is trading around $141, exhibiting a period of consolidation within a narrow price range. This consolidation phase indicates a critical juncture for the market, with resistance observed around $175 and support near $125. These levels serve as crucial indicators of SOL’s potential trajectory in the near term.

Bullish Scenario: Anticipating a New All-Time High

For bullish momentum to drive SOL’s price higher, the chart points to a key resistance level at $175. A sustained breakout above this level, confirmed by two consecutive weekly candle closes, could trigger a bullish rally towards a potential target of $294. This target represents a significant upside of over 100% from the current price, making it an attractive prospect for long-term investors and traders.

Anatoly Yakovenko, co-founder of Solana Labs, highlighted the cost-effectiveness of operating a Solana node compared to using the Ethereum network, contributing to the bullish case for Solana. The debate over network efficiency and cost-effectiveness among leading blockchain platforms further supports the potential for SOL’s price appreciation.

In analyzing the significance of the $175 resistance level, anchored VWAP bands provide a nuanced perspective by combining volume and price data to identify areas where institutional players may enter or exit positions. This technical analysis offers valuable insights for traders seeking to capitalize on potential price movements.

Bearish Scenario: Assessing Downside Risks and Support Levels

Conversely, a bearish scenario could materialize if Solana fails to maintain its current support levels. A breach below the crucial support level of $125, confirmed by two consecutive weekly candle closes, may signal the beginning of a downtrend. In such a scenario, the next major support level is identified at $65, representing a substantial downside risk for SOL investors.

Understanding the technical indicators, such as standard deviation bands based on anchored VWAP from the all-time low of SOL/USD, can provide valuable insights for traders and algorithms. These bands help identify potential reversal points, overbought or oversold conditions, and areas of strong support and resistance based on historical price action.

Conclusion: Navigating a Critical Juncture for Solana

In conclusion, Solana’s price stands at a pivotal juncture, with key resistance and support levels guiding its potential trajectory. Traders and investors should closely monitor the $175 and $125 levels for signals of bullish or bearish momentum. Anchored VWAP and standard deviation bands offer dynamic insights into market sentiment, aiding decision-making in a volatile environment.

This analysis serves as a comprehensive guide for cryptocurrency investors looking to navigate the complexities of the Solana market. While the future price movements of SOL remain uncertain, a thorough understanding of key resistance and support levels, technical indicators, and market dynamics can empower investors to make informed decisions in a rapidly evolving landscape. Remember, this is not financial advice, and thorough research is essential before making any investment decisions. Visit us at ForexLive.com for additional perspectives on cryptocurrency investing.