The Australian Dollar (AUD) and US Dollar (USD) Exchange Rate

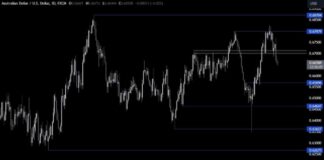

The Australian Dollar (AUD) and US Dollar (USD) exchange rate has been experiencing significant movements in recent weeks. The AUD/USD pair saw a rally from 0.6348, extending higher last week and breaking the temporary top at 0.6642. This has shifted the initial bias to the upside for the upcoming week, with further potential for a rise to 0.6798 resistance. However, a downside risk exists if the pair falls below 0.6569 minor support, which could lead to a retreat.

In the broader perspective, the price actions from the 2022 low of 0.6169 indicate a medium-term corrective pattern. The current rise from 0.6340 suggests the development of another rising leg, with a potential break of the 0.6798/6870 resistance zone targeting the 0.7156 resistance level. Should a decline occur, strong support is expected within the 0.6169/6361 range to initiate a rebound.

Looking at the long-term picture, the downtrend from the 2011 high of 1.1079 appears to have concluded at the 2020 low of 0.5506. The ongoing price actions from 0.5506 are uncertain in terms of whether they are forming a corrective pattern or a trend reversal. Regardless, the fall from 0.8006 is considered the second leg of the pattern, with potential for a deeper decline that would find strong support above 0.5506 to signal a reversal.

Factors Influencing the AUD/USD Exchange Rate

Several factors influence the movements of the AUD/USD exchange rate. One significant factor is the economic data releases from both Australia and the United States. Positive economic data, such as strong GDP growth, low unemployment rates, and stable inflation levels, can lead to a stronger Australian Dollar against the US Dollar. On the other hand, negative economic data can weaken the Australian Dollar relative to the US Dollar.

Another key factor is the interest rate differentials between the Reserve Bank of Australia (RBA) and the Federal Reserve (Fed). If the RBA raises interest rates while the Fed keeps them steady, or vice versa, it can impact the exchange rate. Higher interest rates in Australia attract foreign investors seeking higher returns on their investments, leading to an appreciation of the Australian Dollar.

Political events and geopolitical tensions also play a role in the AUD/USD exchange rate. Uncertainty surrounding elections, trade agreements, or international conflicts can cause fluctuations in the currency pair. For example, trade tensions between the US and China have historically affected the Australian Dollar due to Australia’s close economic ties with China.

Market sentiment and risk appetite are additional factors that influence the AUD/USD exchange rate. In times of global economic uncertainty, investors tend to flock to safe-haven assets like the US Dollar, causing the Australian Dollar to weaken. Conversely, when risk appetite is high, investors may be more willing to invest in higher-yielding assets like the Australian Dollar, leading to its appreciation against the US Dollar.

Technical Analysis of the AUD/USD Pair

Technical analysis is a valuable tool for traders and investors to forecast future price movements based on historical data and chart patterns. In the case of the AUD/USD pair, several technical indicators can provide insight into potential trends and levels of support and resistance.

One commonly used indicator is the Moving Average Convergence Divergence (MACD), which helps identify changes in momentum. A bullish MACD crossover suggests a potential uptrend, while a bearish crossover indicates a possible downtrend. Traders often use the MACD to confirm buy or sell signals.

Another important indicator is the Relative Strength Index (RSI), which measures the speed and change of price movements. An RSI above 70 indicates that a currency pair may be overbought, while an RSI below 30 suggests it may be oversold. Traders can use the RSI to identify potential reversal points in the market.

Support and resistance levels are critical in technical analysis, as they indicate where the price is likely to encounter barriers. Support levels act as a floor for the price, preventing it from falling further, while resistance levels act as a ceiling, preventing the price from rising. Traders often look for breakouts above resistance or below support levels to enter trades.

In conclusion, the AUD/USD exchange rate is influenced by a variety of factors, including economic data, interest rates, political events, and market sentiment. Technical analysis can provide valuable insights into potential trends and levels of support and resistance for traders and investors. By staying informed and utilizing both fundamental and technical analysis, market participants can make more informed decisions when trading the AUD/USD pair.