Walmart Stock Price Analysis: Key Levels to Watch After Record Surge

Walmart shares experienced a significant surge on Thursday following the company’s second-quarter earnings report, which exceeded expectations and raised its full-year outlook. The surge was attributed to cost-conscious consumers turning to the discount retailer for essential items. The stock reached a record high closing price of $73.18, marking a 6.6% increase.

Technical Analysis of Walmart’s Stock

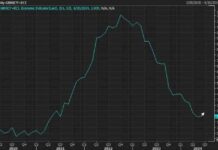

Walmart’s stock has been on an upward trend since the 50-day moving average crossed above the 200-day moving average in November 2022, signaling a golden cross buy signal. Despite a recent 6% pullback, the stock found support near the 50-day moving average before the earnings-driven jump to a new all-time high.

The surge in Walmart’s shares on Thursday was accompanied by the highest trading volume since mid-May, indicating active participation by institutional investors.

Upside Price Target

With Walmart’s shares now trading in uncharted territory, a bars pattern analysis can be used to project a potential upside target. By taking the stock’s trending move from early May to mid-July and positioning it from this month’s low, a projected upside target of around $80 is identified.

Based on historical price movements, the timeframe for reaching this target is estimated to be around late October, given that the prior trending move took place over 52 trading days.

Retracement Areas to Monitor

While Walmart’s stock hit a record high on Thursday, there is a possibility of profit-taking after such a strong move, especially with the relative strength index (RSI) indicator nearing overbought territory. Investors are advised to monitor two key support levels that may come into play during potential retracements.

The first support level is around $71, near the stock’s previous record high, which may need to be tested before a sustained move higher. A more significant pullback could see the shares retesting the $62 area, just above the rising 200-day moving average. This level is likely to find support from a two-month period of price consolidation between March and May.

Conclusion

The surge in Walmart’s stock price following the second-quarter earnings report highlights the company’s strong performance and investor confidence. With technical analysis indicating potential upside targets and key support levels, investors can make informed decisions regarding their positions in Walmart’s stock.

As always, it is important for investors to conduct their own research and consider their risk tolerance before making any investment decisions.