Reserve Bank of New Zealand Makes Bold Move with Rate Cut Decision

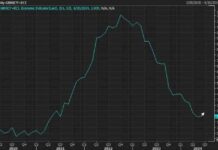

The Reserve Bank of New Zealand (RBNZ) surprised many analysts this week by kicking off its rate cut cycle, lowering its policy interest rate by 25 basis points to 5.25%. The decision marks a significant shift in the central bank’s stance, as most experts had expected the RBNZ to keep rates steady.

Factors Behind the Rate Cut Decision

Several key factors influenced the RBNZ’s decision to cut rates. The central bank pointed to slowing inflation and declining inflation expectations as primary reasons for the move. Additionally, weak sentiment surveys and mixed labor market figures indicate that spare capacity in the economy is likely to continue growing. This growing spare capacity gives the RBNZ confidence that inflation will eventually return to the target range.

In addition to the rate cut, the RBNZ also revised its projections for future interest rates, signaling a faster pace of easing. The central bank now expects the policy interest rate to reach 3.85% by the fourth quarter of 2025. This shift in projections demonstrates the RBNZ’s commitment to further rate cuts in the coming months.

Impact on the New Zealand Economy

The RBNZ’s decision to cut rates reflects the current state of the New Zealand economy. With weak economic growth and a period of monetary easing ahead, the New Zealand dollar is expected to underperform against other major currencies in the medium term. Modest gains in the NZ currency versus the US dollar are anticipated through the end of 2025.

Looking Ahead

The RBNZ’s rate cut decision is just the beginning of what is expected to be a series of rate cuts in the near future. Analysts predict 25 basis points rate cuts at each meeting through May 2025, with additional cuts in August and November of next year. This trajectory would see the policy rate at 4.75% by the end of 2024 and 3.50% by the end of 2025.

Overall, the RBNZ’s move to lower interest rates reflects the current economic conditions in New Zealand. With inflation slowing and economic growth weak, the central bank is taking proactive steps to stimulate the economy and bring inflation back to target levels. As the RBNZ continues its easing cycle, the New Zealand dollar is likely to face challenges against other major currencies.

In conclusion, the Reserve Bank of New Zealand’s decision to cut rates signals a new phase of monetary policy in the country. With a focus on stimulating the economy and achieving inflation targets, the RBNZ is taking bold steps to support growth in the face of challenging economic conditions. As the central bank continues its rate cut cycle, the New Zealand economy and currency are expected to face further adjustments in the coming months and years.