Bank of England Maintains Bank Rate Amid Dovish Vote Split

In a highly anticipated monetary policy meeting today, the Bank of England (BoE) opted to keep the Bank Rate unchanged at 4.75%. This decision was widely expected by market analysts and economists alike. The vote split revealed a dovish sentiment, with 6 members voting for no change, while Dhingra, Ramsden, and newcomer Taylor advocated for a 25 basis point cut.

Gradual Approach to Policy Restraint Reduction

Despite the dovish tilt in the voting, the BoE reiterated its commitment to a gradual approach to easing the restrictiveness of monetary policy. The central bank emphasized the need for policy to remain restrictive until inflation risks subsided further. The Monetary Policy Committee (MPC) noted that the labor market was in a state of balance and revised its growth forecast for Q4 downwards due to recent indicators showing weakening growth.

Expectations and Projections for 2025

Given the recent positive surprises in wage and inflation data, coupled with a fiscal stance leaning towards expansion, analysts anticipate a series of quarterly rate cuts throughout 2025. The first 25 basis point cut is expected in February, with the Bank Rate projected to end the year at 3.75%. Despite maintaining the terminal rate forecast at 2.75%, analysts foresee reaching this level by Q4 2026.

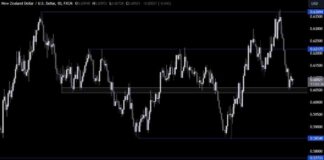

Market Reactions and Outlook

Following the announcement, Gilt yields experienced a slight decline, while the EUR/GBP exchange rate saw an upward movement. Market expectations suggest a total of 18 basis points in cuts by February and 55 basis points by the end of 2025. However, analysts caution that there might be more easing by the BoE than currently priced in, with a potential total of 100 basis points worth of easing throughout the year.

As the BoE adopts a more cautious stance compared to its European counterparts, supported by the UK’s economic performance and credit spreads, analysts foresee a continued downward trend for the EUR/GBP exchange rate. The key risk identified is a softer stance from the Bank of England.

In conclusion, the BoE’s decision to maintain the Bank Rate and its dovish vote split signal a cautious approach to monetary policy in 2025. Analysts anticipate a series of rate cuts throughout the year, with market reactions and projections pointing towards a potentially more accommodative stance from the central bank.