Canada – BoC Cuts Rates, Signals Uncertainty

In a bold move this week, the Bank of Canada (BoC) lowered its policy rate by 50 basis points to 3.25%. This marks the second consecutive significant cut, totaling 175 bps of easing since June. The decision aligns with market expectations but triggered turbulent market movements throughout the week. The Canadian dollar initially rose post-meeting before ultimately falling to 0.7030 U.S. cents by week’s end. Yields on Canadian bonds also saw an uptick, with the 2 and 10-year bonds climbing by 10 and 15 bps, respectively.

The BoC’s latest announcement reflects a shift in its approach to interest rates. The central bank now views the policy rate as being in a more balanced zone, no longer requiring restrictive measures. With inflation stabilizing around the two percent target, the BoC is prioritizing addressing the softer growth outlook. Notably, the BoC’s statement indicated a more cautious stance on future rate cuts, emphasizing a one-step-at-a-time evaluation approach rather than committing to further reductions.

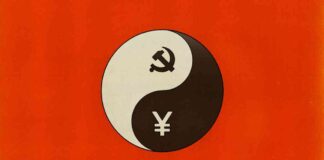

The BoC acknowledged the complex economic landscape ahead, with uncertainties stemming from both domestic and external factors. External threats, such as potential tariffs on Canadian exports by U.S. President-elect Donald Trump, pose challenges to Canada’s economic prospects. Meanwhile, changes in immigration policies and fiscal stimuli could impact consumer spending dynamics in the near term. Despite these uncertainties, rising household wealth in Canada points to a positive outlook for consumer spending in the coming quarters.

Forecast and Analysis for BoC in 2025

Looking ahead, analysts anticipate the BoC to implement another 100 bps of cuts in 2025, aiming to reach a neutral rate of 2.25%. The gradual pace of rate adjustments reflects the central bank’s strategy to balance economic slack closure while preventing inflation resurgence. Navigating through various economic forces, the BoC faces a challenging period of decision-making to fine-tune interest rates effectively.

U.S. – Fed’s December Cut Expected

Across the border, the U.S. economy is gearing up for the Federal Open Market Committee’s (FOMC) anticipated quarter-point rate cut next week. Recent data indicating a slowdown in inflation growth has prompted expectations for a more measured approach to policy easing in 2025. The FOMC’s upcoming release of economic projections will offer insights into policymakers’ views on the economic outlook and future rate adjustments post-election.

In the wake of evolving inflation trends and policy uncertainties, the FOMC is likely to consider a ‘pause’ on rate cuts in January, shifting towards a more cautious approach to monetary policy adjustments. With inflationary pressures showing signs of stalling, FOMC members are expected to navigate a path that balances economic stability with policy flexibility in response to potential fiscal changes under the new administration. The upcoming policy announcement is poised to shed light on the Fed’s strategy for maintaining economic momentum amid shifting global dynamics.