ECB to Decide on Rate Cut Amidst Political Turmoil

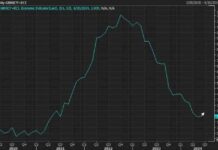

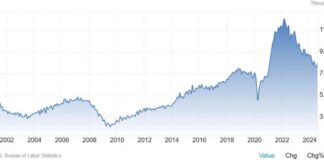

The European Central Bank (ECB) is set to hold its final meeting for 2024 on Thursday, with all eyes on whether they will increase the rate cut to 50bps. This decision comes amidst ongoing political turmoil in the eurozone’s biggest economies, including France and Germany, and external factors such as President-elect Trump’s trade strategy. The outcome of this meeting could have significant implications for the eurozone economy and the global financial markets.

Four Market-Moving Factors to Watch

As investors wait for the ECB’s decision, there are four key factors that could potentially shake up the markets. The size of the rate cut, the press statement, President Lagarde’s press conference, and the quarterly staff forecasts are all crucial elements that could impact the euro/dollar exchange rate. Market expectations have been fluctuating between a 25bps and 50bps rate cut, with doves advocating for a larger cut to support the struggling eurozone economy. The December staff forecast will also shed light on the future path of ECB rates, with a focus on inflation figures and growth rates for the coming years.

Two Scenarios for the ECB Meeting

Investors are preparing for two main scenarios following the ECB meeting. Scenario 1 involves a 25bps rate cut, maintaining a dovish stance, and signaling readiness for further actions in response to potential trade wars initiated by President Trump. In this case, the euro may experience some initial fluctuations but is expected to stabilize post-Lagarde’s press conference. Scenario 2, on the other hand, entails a more aggressive 50bps rate cut and a heightened dovish stance in light of economic uncertainties and possible tariffs from Trump. President Lagarde’s comments on continued rate cuts and the ECB deposit rate could further impact the euro’s performance in the global markets.

In conclusion, the upcoming ECB meeting holds significant weight for the eurozone economy and global financial stability. Investors and market participants will closely monitor the decision and its implications on the euro/dollar exchange rate, inflation figures, and future rate cuts. The outcome of this meeting will not only shape the economic landscape in 2024 but also set the tone for financial markets heading into 2025.