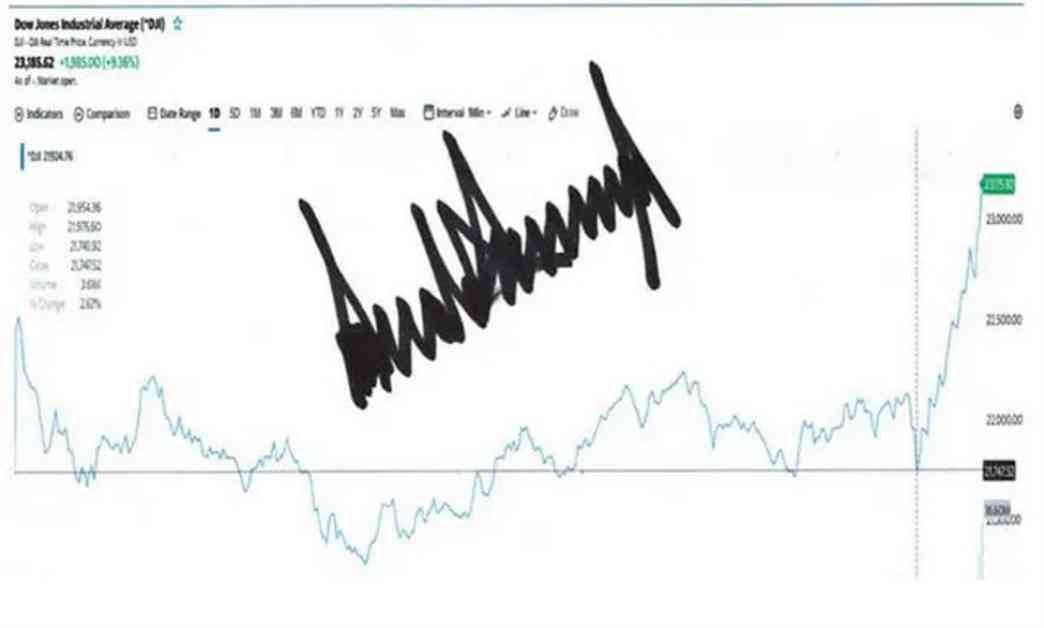

The US stock markets saw significant gains this week, with the Russell 2000 index experiencing its largest weekly increase since 2000. This surge in stock prices was fueled by a variety of factors, including the recent autograph signing by former President Trump on a stock chart.

Closing changes on the day showed the S&P 500 with a 0.4% increase, reaching a record high close. The Nasdaq Composite also saw a slight uptick of 0.1%, while the DJIA rose by 0.6% and the Russell 2000 by 0.7%. However, the Toronto TSX Composite experienced a slight decline of 0.4%.

Looking at the weekly changes, the S&P 500 recorded a 4.7% increase, while the Nasdaq Composite saw a 5.7% rise. The Russell 2000 outperformed all other indices with an impressive 8.6% gain, while the Toronto TSX Composite increased by 2.1%.

The outperformance of the Russell 2000 can be attributed to its heavy weighting in the banking sector, as investors anticipate that Republicans will relax banking regulations. Additionally, the index’s focus on domestic companies is expected to benefit from potential tax cuts and may be less impacted by tariffs compared to other indices.

Despite the significant gains, the Russell 2000 has yet to reach a record high and may face some resistance in the near future. Investors should keep an eye on this index in the coming weeks to see how it performs.

Overall, the recent market movements highlight the impact of political events on stock prices and the importance of diversification in investment portfolios. It’s essential for investors to stay informed about market trends and be prepared for potential fluctuations in the future.