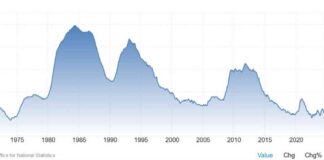

Chicago Federal Reserve President Austan Goolsbee recently spoke to CNBC about the progress in controlling inflation and stabilizing the labor market in the last year and a half. According to Goolsbee, inflation has decreased significantly, and the job market has calmed down to a point that is close to what is considered full employment.

Moving forward, Goolsbee mentioned that policymakers generally agree that interest rates will have to be reduced by a considerable amount in the coming months. Despite this consensus, he anticipates that the Federal Open Market Committee (FOMC) will have some challenging decisions to make due to conflicting economic data.

As Goolsbee’s insights suggest, the Federal Reserve will likely face some tough choices when determining the appropriate course of action regarding interest rates. With the economy experiencing mixed signals, the FOMC will need to carefully analyze the data and make decisions that best support economic stability and growth.

It is essential for policymakers to strike a balance between stimulating economic activity and preventing runaway inflation. By closely monitoring key indicators and trends, the Federal Reserve can make informed decisions that benefit the overall economy.

In conclusion, Goolsbee’s remarks shed light on the complexity of managing monetary policy in a dynamic economic environment. As the Federal Reserve navigates through uncertain times, close attention to data and careful deliberation will be crucial in shaping future rate decisions.