Fed Rate Cuts Begin: Forexlive Americas FX News Wrap 18 Sep

The Federal Reserve Bank kicked off the easing cycle with a significant cut of 50 basis points, marking a shift in policy stance away from a period of high inflation and low employment. The Fed’s new baseline focuses on maintaining steady inflation levels while addressing the issue of not-too-low employment rates. This move aims to reduce the restrictiveness of the current interest rates without signaling an imminent economic downturn. With two more meetings on the horizon, the Fed anticipates two additional cuts of 25 basis points each. However, the market’s outlook suggests a total of 125 basis points in cuts for 2024, inclusive of the recent 50 basis point reduction, while the Fed remains more conservative with a projection of 100 basis points.

Fed Chair Powell’s Commentary on Key Topics

Economy: Powell remains optimistic about the economy, stating that there are no signs pointing to an increased likelihood of a downturn. He emphasizes that GDP growth is expected to remain solid and that recent indicators such as retail sales and Q2 GDP reflect a healthy pace of growth.

Interest Rates and Inflation: Powell acknowledges the need for gradual adjustments towards normal interest rate levels but refrains from declaring victory over inflation. While inflation has eased slightly, it remains above the Fed’s 2% target. Powell notes that wage increases are slightly exceeding the inflation goal, and longer-term inflation expectations are stable. The Fed’s patient approach has been effective in managing inflation while avoiding a return to negative rates for long-term bonds.

Labor Market: Powell highlights the strength of the labor market, with healthy unemployment rates and strong labor market participation. Job vacancies remain high, although Powell acknowledges rising downside risks to employment. He emphasizes the importance of supporting the labor market while it remains robust, without the need for immediate loosening.

Housing: Powell notes that housing inflation is lagging and market rents are not decreasing as expected. The housing market is facing challenges due to higher rates, leading to a lack of supply and a decline in housing sector investment. Powell expects the housing market to normalize as rates decrease, with the key issue being the insufficient supply.

Monetary Policy: The Fed continues to operate on a meeting-by-meeting basis with no predefined course of action. Powell emphasizes the flexibility to adjust policy based on economic conditions, aiming to restore the balance between supply and demand. The Fed’s reserves remain stable, and there are no immediate plans to halt the runoff of assets.

General Commentary: Powell cautions against assuming that current conditions reflect a new pace of growth, highlighting the Fed’s patient and timely decisions to stay ahead of economic trends. The next meeting is scheduled after the November election, with key economic indicators such as employment and inflation data to be monitored closely in the upcoming months.

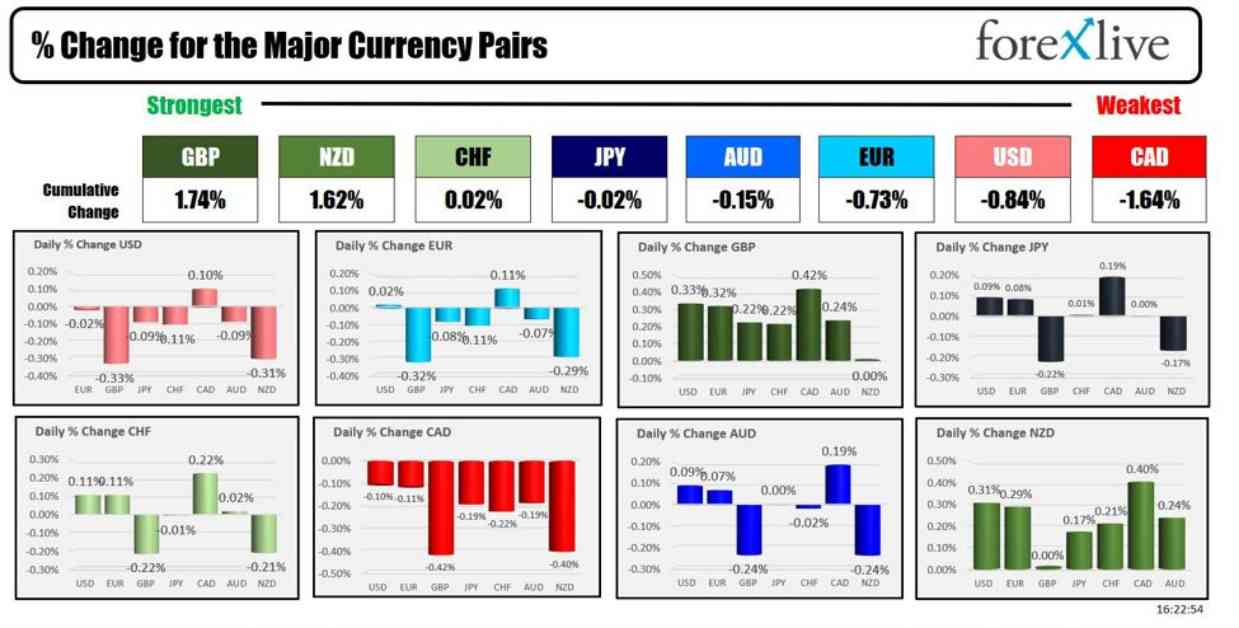

Overall, the Fed’s decision to cut rates by 50 basis points has impacted the forex market, leading to a decline in the USD initially. However, as the market digested Powell’s comments and technical factors came into play, the USD’s losses were mitigated. By the end of the day, the CAD emerged as the weakest major currency against the USD, while other currencies such as the EUR, JPY, CHF, and AUD showed minimal changes. The GBP and NZD ended as the strongest currencies for the day.

US stocks experienced volatility, with gains erased by the closing bell, resulting in major indices finishing lower. The bond market saw an overall increase in yields across all points on the curve, despite the rate cut:

• 2-year yield: 3.69%, +3.6 basis points

• 5-year yield: 3.491%, +5.8 basis points

• 10-year yield: 3.707%, +6.6 basis points

• 30-year yield: 4.027%, +7.5 basis points

In other markets, crude oil prices dipped by approximately 1.05%, while gold, after reaching new all-time highs post-rate cut, saw a slight decrease to $2558. Silver also experienced a decline, trading at $30.03, and Bitcoin hovered above the $60,000 mark at $60,195.

Looking ahead, the Bank of England is expected to maintain steady rates following a previous cut, with the market closely monitoring the outcome. The GBPUSD pair tested a key swing area but ended the day lower, awaiting the BOE’s decision scheduled for 7:00 AM ET.

The Fed’s proactive stance towards economic shifts and inflation management has set the stage for future monetary policy decisions. With the economy showing signs of resilience and stability, the Fed’s measured approach aims to support growth while addressing potential risks.