NZDUSD Bulls Assert Dominance Ahead of FOMC Rate Decision

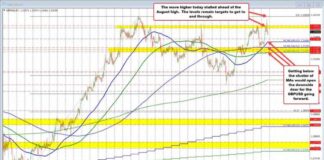

The NZDUSD pair has been showing strength in the markets as investors eagerly await the Federal Open Market Committee (FOMC) rate decision. Bulls have managed to take control, pushing the pair above its 20-day simple moving average (SMA) at 0.6195. This is a significant development as the 20-day SMA has previously acted as a barrier to bullish movements.

With the pair trading above the 20-day SMA, there is a positive bias in the short term. However, there are still obstacles on the upside that need to be overcome for further gains. Investors are closely watching key levels to gauge the potential for more upside momentum.

Key Levels to Watch

One crucial level to monitor is the descending line that connects the February and December 2023 highs at 0.6233. A break above this level could signal more gains for the NZDUSD pair, potentially pushing it towards the descending line from July 2023 at 0.6290. Additionally, the 23.6% Fibonacci retracement level of the October 2022-February 2023 uptrend sits at 0.6300, posing another hurdle for the pair.

For a sustained uptrend, the NZDUSD pair may need to surpass the December 2023 peak of 0.6368. However, if the pair fails to hold above the 20-day SMA, it could find support near the trendline at 0.6172. Further downside movement could target the 38.2% Fibonacci retracement level at 0.6120 and the long-term falling line from February 2022.

Technical Analysis and Outlook

From a technical standpoint, the bias for NZDUSD remains tilted to the upside, supported by positive indicators. However, caution is advised as the stochastic oscillator has climbed above the 80 overbought level, signaling a potential reversal near the 0.6233 resistance.

In summary, while the NZDUSD pair maintains a bullish bias, there are still hurdles to overcome at 0.6233 and 0.6300 before a more definitive short-term outlook can be established.

About XM.com

XM.com is a leading financial services provider offering online trading services in various asset classes, including currency exchange, commodities, equity indices, precious metals, and energies. Founded in 2009 by market experts with deep knowledge of the global forex and capital markets, XM is committed to delivering fair and reliable trading conditions to clients worldwide.

With a strong focus on customer success, XM offers competitive trading conditions, including tight spreads, flexible leverage, and personalized customer engagement. Traders from over 196 countries trust XM for its exceptional execution of orders and commitment to providing a secure trading environment.

In conclusion, the NZDUSD pair continues to attract attention from investors ahead of the FOMC rate decision. While bullish momentum is evident in the short term, key levels and technical indicators suggest caution is warranted. As the markets await further developments, traders will be closely monitoring the pair’s performance for clues on its next moves.