Analysis of FOMC Rate Cut Decision

The Federal Reserve is at a crossroads, debating whether to make a modest 0.25 percentage point cut or a more aggressive 0.5-point reduction at its upcoming meeting. This decision comes amidst growing concerns about the state of the economy and the potential impact of ongoing trade tensions. Federal Reserve Chairman Jerome Powell has kept all options on the table, indicating a willingness to act decisively to support economic growth.

Fed’s Dilemma: Small vs. Big Cut

The debate within the Fed centers around the potential risks and rewards of a smaller versus a larger rate cut. On one hand, a conservative 0.25-point reduction may be seen as a cautious approach, providing some stimulus to the economy without signaling panic. On the other hand, a more aggressive 0.5-point cut could have a more significant impact, boosting consumer and business confidence and spurring investment and spending.

Market Expectations and Economic Indicators

Market sentiment currently favors a 0.25-point cut, with many investors anticipating this more conservative approach. However, there are also forecasts circulating for a larger 0.5-point cut, reflecting concerns about the global economic outlook and the potential for a sharper slowdown.

Recent economic data has been mixed, with firmer housing costs in the consumer-price index report weakening the case for a larger cut. Additionally, revised hiring numbers for June and July showed weaker job growth than initially reported, although payroll growth improved in August. These conflicting signals have added to the uncertainty surrounding the Fed’s decision.

Broader Strategy and Future Rate Cuts

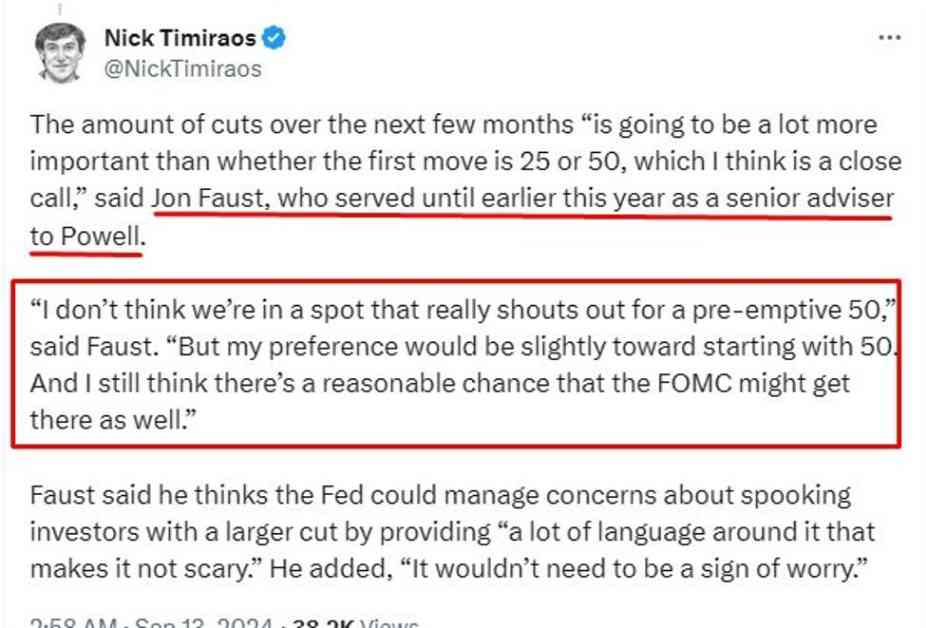

The tactical question of whether to start with a 0.25 or 0.5-point cut could offer insights into the Fed’s broader strategy for future rate adjustments. The amount and pace of rate cuts over the coming months will be crucial in determining the overall impact on the economy. Jon Faust, a former senior adviser to Powell, emphasized that the total magnitude of cuts is more important than the initial move, highlighting the need for a coordinated and strategic approach.

In conclusion, the Federal Reserve faces a challenging decision as it navigates the uncertain economic landscape. The choice between a small or big rate cut will have far-reaching implications for monetary policy, financial markets, and the broader economy. The Fed’s ability to strike the right balance between supporting growth and managing risks will be critical in the months ahead.