ClearBridge Energy MLP Strategy recently provided an update on their performance and analysis for the second quarter of 2024. The company is known for its active management approach, focusing on research-based stock selection to guide their investment strategies. In the midstream sector, ClearBridge saw strong performance, driven by execution, an improving natural gas price outlook, and the recognition of the key role midstream infrastructure plays in supporting renewable power as AI demand grows.

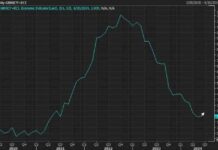

The second quarter saw midstream energy stocks outperforming the overall energy sector, with the Alerian MLP Index rising 3.35% while the S&P 500 energy sector fell 2.42%. Natural gas prices increased by 47.5% to end the quarter at $2.60 per mmbtu, and OPEC+ supply cuts contributed to a recovery in crude oil prices. Looking ahead, the trajectory of oil prices will likely be influenced by demand factors rather than supply.

In terms of natural gas, the short-term outlook may be negative, but the intermediate- to long-term outlook remains positive. Factors such as increasing demand for natural gas in U.S. electricity generation and the growth of U.S. liquefied natural gas export capacity are expected to drive prices higher in the coming years.

Despite the challenges faced by global economies, ClearBridge remains optimistic about the MLP market. Valuations for U.S. midstream companies are currently below pre-pandemic levels, with solid financial metrics and low valuations providing upside potential for the sector. The ClearBridge Energy MLP Strategy also outperformed its benchmark during the second quarter, with positive contributions from various subsectors and individual holdings.

Overall, ClearBridge Investments emphasizes that past performance is not indicative of future results. The company’s opinions and data are subject to change, and the information provided should not be used as the sole basis for making investment decisions. Investors should be aware of the risks associated with securities that do not trade on major U.S. exchanges.

In conclusion, ClearBridge Energy MLP Strategy’s Q2 2024 update and analysis highlight the company’s commitment to active management and research-based stock selection. Despite challenges in the global economy, ClearBridge remains positive about the outlook for the midstream sector and sees opportunities for growth and performance in the coming years. Investors should consider these insights and analysis when making investment decisions in the energy sector.